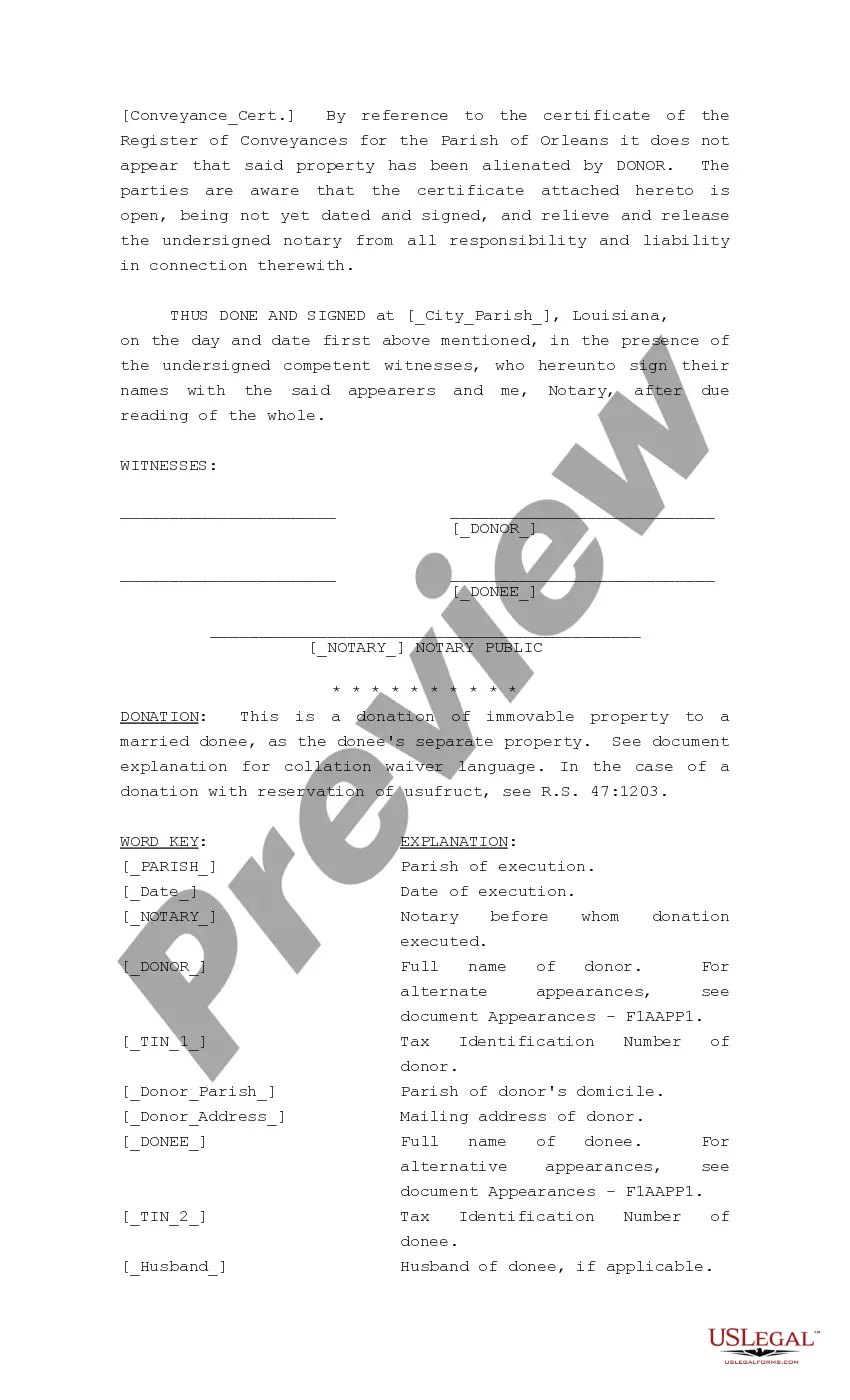

This is an example of a donation of immovable property to a married donee, as the donee's separate property. In the case of a donation with reservation of usufruct, see LA. R.S. 47:1203 The Louisiana Act of Donation for Vehicle, also known as the Vehicle Donation Act in Louisiana, is a legal process that allows individuals to transfer ownership of a vehicle through a voluntary donation. This act serves as a beneficial means for both the donor and the recipient organization. Louisiana recognizes different types of Act of Donation for Vehicle, including inter vivos and Morris cause donations. An inter vivos donation refers to a vehicle donation made during the donor's lifetime. It involves a voluntary transfer of ownership from the donor to the recipient organization without any exchange of money. This type of donation is typically used when a vehicle owner wishes to support a charitable cause or organization, while also removing the burden of owning and maintaining the vehicle. On the other hand, a Morris cause donation is a vehicle donation that takes effect upon the donor's death as part of their estate plan. This type of donation allows individuals to include their vehicles as charitable gifts in their will or trust. By doing so, the donor can support a cause they value while receiving potential tax benefits and reducing the value of their estate for estate tax purposes. When initiating a Louisiana Act of Donation for Vehicle, certain key elements must be considered. First, the donor should select a reputable recipient organization that meets the necessary criteria for accepting vehicle donations. It is vital to verify if the organization is eligible to receive tax-deductible donations, as this factor may provide the donor with tax benefits. Additionally, the donor must gather and provide the required documentation, including the vehicle's title, registration, and any other supporting documents such as maintenance records. This ensures a smooth transfer of ownership and protects both parties involved. Once the Act of Donation is complete, the recipient organization assumes ownership of the donated vehicle. They may choose to use the vehicle for their operational needs, sell it to raise funds for their cause, or offer it to those in need. The specific purpose of the vehicle depends on the policies and objectives of the recipient organization. Overall, Louisiana's Act of Donation for Vehicle offers a unique opportunity for individuals to support charitable causes of their choice while simplifying the process and potential tax benefits. It provides a win-win situation by allowing donors to make a positive impact, while also relieving themselves from the responsibilities associated with vehicle ownership.

The Louisiana Act of Donation for Vehicle, also known as the Vehicle Donation Act in Louisiana, is a legal process that allows individuals to transfer ownership of a vehicle through a voluntary donation. This act serves as a beneficial means for both the donor and the recipient organization. Louisiana recognizes different types of Act of Donation for Vehicle, including inter vivos and Morris cause donations. An inter vivos donation refers to a vehicle donation made during the donor's lifetime. It involves a voluntary transfer of ownership from the donor to the recipient organization without any exchange of money. This type of donation is typically used when a vehicle owner wishes to support a charitable cause or organization, while also removing the burden of owning and maintaining the vehicle. On the other hand, a Morris cause donation is a vehicle donation that takes effect upon the donor's death as part of their estate plan. This type of donation allows individuals to include their vehicles as charitable gifts in their will or trust. By doing so, the donor can support a cause they value while receiving potential tax benefits and reducing the value of their estate for estate tax purposes. When initiating a Louisiana Act of Donation for Vehicle, certain key elements must be considered. First, the donor should select a reputable recipient organization that meets the necessary criteria for accepting vehicle donations. It is vital to verify if the organization is eligible to receive tax-deductible donations, as this factor may provide the donor with tax benefits. Additionally, the donor must gather and provide the required documentation, including the vehicle's title, registration, and any other supporting documents such as maintenance records. This ensures a smooth transfer of ownership and protects both parties involved. Once the Act of Donation is complete, the recipient organization assumes ownership of the donated vehicle. They may choose to use the vehicle for their operational needs, sell it to raise funds for their cause, or offer it to those in need. The specific purpose of the vehicle depends on the policies and objectives of the recipient organization. Overall, Louisiana's Act of Donation for Vehicle offers a unique opportunity for individuals to support charitable causes of their choice while simplifying the process and potential tax benefits. It provides a win-win situation by allowing donors to make a positive impact, while also relieving themselves from the responsibilities associated with vehicle ownership.

Free preview How To Donate Property To Family Member In Louisiana

Obtaining legal document samples that comply with federal and state laws is essential, and the internet offers many options to choose from. But what’s the point in wasting time looking for the right Louisiana Act Of Donation For Vehicle sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the most extensive online legal catalog with over 85,000 fillable templates drafted by lawyers for any business and personal scenario. They are simple to browse with all files grouped by state and purpose of use. Our specialists stay up with legislative changes, so you can always be confident your form is up to date and compliant when getting a Louisiana Act Of Donation For Vehicle from our website.

Getting a Louisiana Act Of Donation For Vehicle is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the right format. If you are new to our website, adhere to the steps below:

All templates you locate through US Legal Forms are multi-usable. To re-download and complete earlier obtained forms, open the My Forms tab in your profile. Take advantage of the most extensive and straightforward-to-use legal paperwork service!